after tax income calculator iowa

The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month. Iowa Income Tax Calculator 2021.

Llc Tax Calculator Definitive Small Business Tax Estimator

You can alter the salary example to illustrate a different filing status or show.

. Compound Interest Calculator Present. After Tax Income Calculator Iowa. Financial Facts About the US.

The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income. Your average tax rate is 1069 and your marginal tax rate is 22. However the rates will be gradually reduced to meet the revenue.

The Iowa Income Taxes Estimator Lets You Calculate Your State Taxes For the Tax Year. Corporations in Iowa pay four different rates of income tax. If you make 55000 a year living in the region of Iowa USA you will be taxed 11457.

Tax March 2 2022 arnold. If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Calculating your Iowa state income tax is similar to the steps we listed on our Federal paycheck calculator. After Tax Income Calculator Iowa. After Tax Income Calculator Iowa.

That means that your net pay will be 43543 per year or 3629 per month. The Iowa Income Taxes Estimator. You can alter the salary example to illustrate a different filing status or show.

Calculate your net income after taxes in Iowa. This places US on the 4th place out of. After Tax Income Calculator Iowa.

The top marginal rate of 98 will remain in place until 2022. 15 Tax Calculators. So the tax year 2022 will start from July 01 2021 to June 30 2022.

If you make 62000 a year living in the region of Iowa USA you will be taxed 11734. Your average tax rate is 1198 and your marginal tax rate is 22. The Federal or IRS Taxes Are Listed.

Using the annual income formula the calculation would be. With five working days in a week this means that you are working 40 hours per week. That means that your net pay will be 43041 per year or 3587 per month.

It can also be used to help fill steps 3 and 4 of a W-4 form. Use ADPs Iowa Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Just enter the wages tax withholdings and other information required.

Iowa Income Tax Calculator 2021. Tax March 2 2022 arnold. Annual Income 15hour x 40 hoursweek x.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. United States Italy France Spain United Kingdom Poland Czech Republic Hungary.

38 000 After Tax Us 2022 Us Income Tax Calculator

Iowa Paycheck Calculator Smartasset

Iowa Conference Free Clergy Tax Video

Car Tax By State Usa Manual Car Sales Tax Calculator

Quarterly Tax Calculator Calculate Estimated Taxes

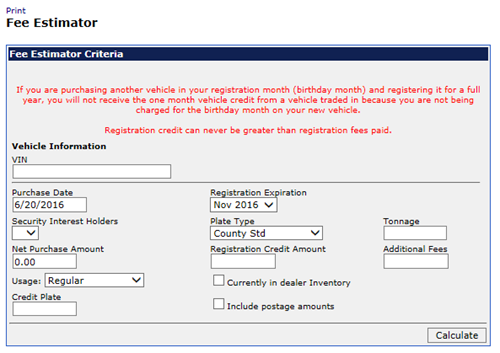

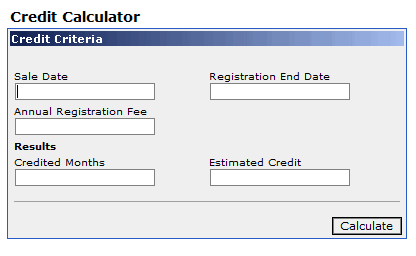

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Tax Day 2021 See If Your State Has Extended The Deadline For Income Tax Returns The Sun

How Is Tax Liability Calculated Common Tax Questions Answered

Iowa S New Flat Tax How It Works

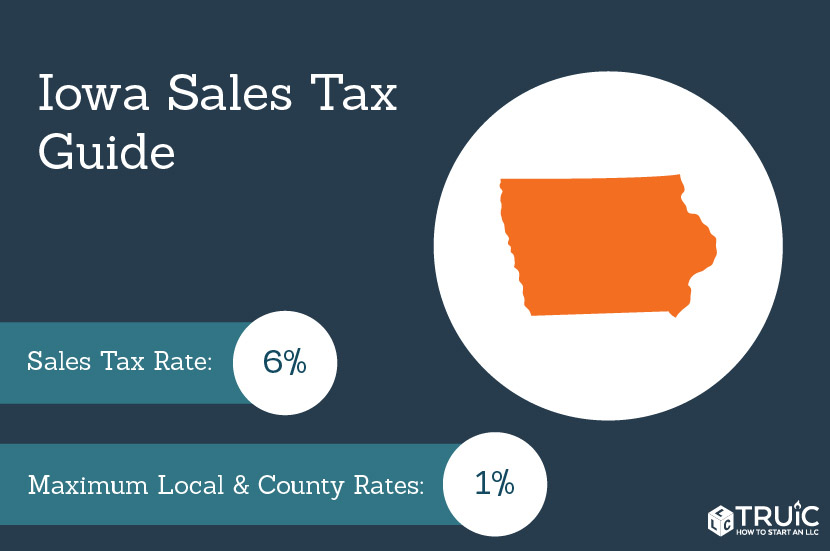

Iowa Sales Tax Small Business Guide Truic

Iowa Salary Paycheck Calculator Gusto

30 An Hour Is How Much A Year Savoteur

Inheritance Tax 2022 Casaplorer

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Sf 2206 Senate S Comprehensive Tax Reform Proposal Iowa League